The “Magic Quadrant” report for the Cloud IaaS market by Gartner is out

Gartner, the leading company in consultancy, research and analysis in the IT field, published the annual “Magic Quadrant” report for the Cloud IaaS market, which is available at this address.

Among the most interesting result we cite the first appearance of two players like Alibaba Cloud (“the vendor's potential [is] to become an alternative to the global hyperscale cloud providers in select regions over time”) and Oracle Cloud, and the disappearance of VMware vCloud Air. AWS maintains its leadership in the first quadrant, followed by Microsoft Azure: both players are the only ones to be in the “Leaders and Visionaries” quadrant, and share most of the market.

Overall, the Cloud IaaS market is described as fragmented and in a reboot phase (many providers are changing their offers and infrastructures) and, given the gap between competitors still keep on growing, some providers are specializing with specific solutions.

The Cloud market will be worth $200bln by 202

A study presented by Synergy Research Group forecasts a growth in revenues from SaaS and Cloud services with an annual average rate of 23-29% for the next five years, reaching a net value of $200 billion by 2020. This will go along with an average annual growth of 11% in the sales of infrastructures to Cloud Providers on hyperscale.

The Public Cloud sector will experience the greatest growth -29% per year- followed by Private Cloud (26%) and SaaS (23%) services. The APAC area will be the region with the biggest growth, then EMEA and North America; the most interested areas will be about databases and IaaS/PaaS services oriented to the IoT.

CommScope to purchase Cable Exchange

CommScope announces its interest in purchasing Cable Exchange, a privately held quick-turn supplier of fiber optic and copper assemblies for data, voice and video communications

Cable Exchange, headquartered in Santa Ana, Calif., manufactures a variety of fiber optic and copper cables, trunks and related products used in high-capacity data centers and other business enterprise applications.The company, founded in 1986, specializes in quick-turn delivery of its infrastructure products to customers from its two U.S. manufacturing centers located in Santa Ana, Calif. and Pineville, N.C.

As more user-driven information and commerce flows through networks, operators are quickly deploying larger and more complex data centers to support growth in traffic and transactions.

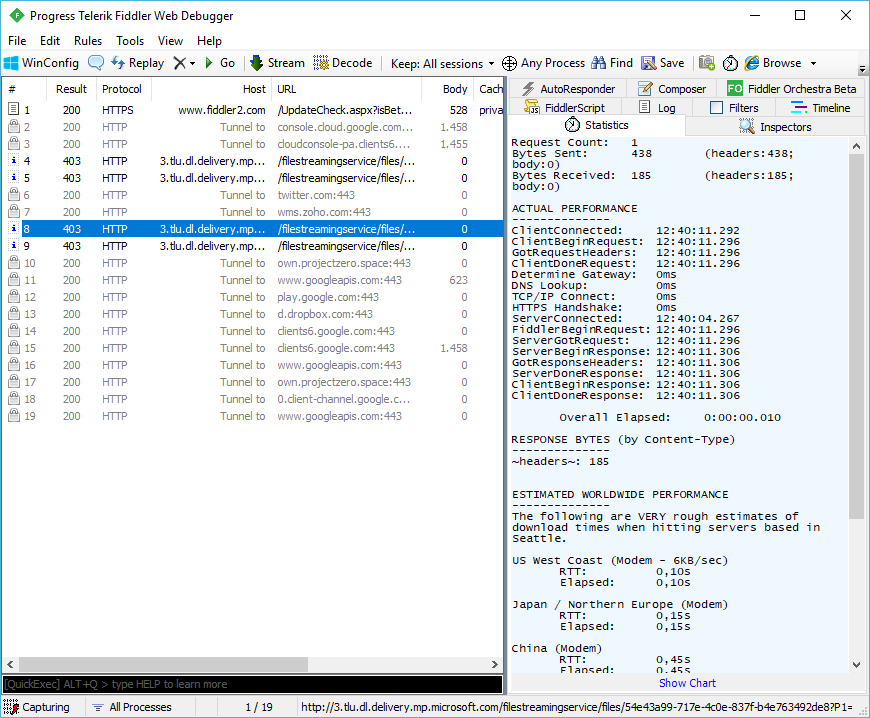

Microsoft purchases Cloudyn

Microsoft announces the acquisition of Cloudyn, an Israelian company specialized in management and monitoring tools for Cloud environments.

Cloudyn offers a SaaS service for monitoring and management of multi-Cloud systems ith Azure, AWS, Google Cloud and OpenStack.

“Cloudyn gives enterprise customers tools to identify, measure and analyze consumption, enable accountability and forecast future cloud spending. As a Microsoft partner, Cloudyn has supported cost management for Microsoft Azure and other public clouds, helping customers continuously improve their cloud efficiency. Cloudyn customers have been able to optimize their cloud services usage and costs through automated monitoring, analytics and cost allocation. Cloudyn capabilities will be incorporated into our product portfolio that offers customers the industry’s broadest set of cloud management, security and governance solutions.” says Jeremy Winter, Director of Program Management for Azure Security and Operations Management.

Alibaba Cloud opens datacenters in India and Indonesia

Alibaba Cloud, the cloud division of Alibaba Group -the chinese counterpart to Amazon- announces the opening of three new datacenters in India and Indonesia.

Datacenters are located in Mumbai (2), India, and in Jakarta, Indonesia; the inauguration is expected by May 30, 2018.

With these three new structures, the total number of datacenters owned by the Chinese giant grows to 17, with properties located in China, Australia, Germany, Japan, Hong Kong, Singapore, USA e United Arab Emirates, in addition to India and Indonesia.

"I believe Alibaba Cloud, as the only global cloud services provider originating from Asia, is uniquely positioned with cultural and contextual advantages to provide innovative data intelligence and computing capabilities to customers in this region. Establishing data centers in India and Indonesia will further strengthen our position in the region and across the globe," said Simon Hu, Senior Vice President of Alibaba Group and President of Alibaba Cloud.

Alibaba entered the cloud computing world in 2009, 3 years after Amazon started AWS. Alibaba Cloud is one of the most ambitious projects the Chinese giant is carrying on.

Nutanix and Google announce a partnership

Nutanix and Google announced a strategic partnership at the Nutanix .NEXT Conference 2017.

As a result of the deal, clients of both companies can implement and manage cloud-based or traditional on-premises applications as a unified public cloud service using the infrastructures of Nutanix and Google Cloud Platform (GCP).

Google and Nutanix will work together to address the technology opportunities for building and operating hybrid clouds that combine the best of private cloud architectures and scalable public cloud environments.

Azure Stack to be shipped in September

Azure Stack will be shipped to clients starting in September. Microsoft announces that its partners (Dell EMC, HPE and Lenovo) are already taking orders for the hardware part of the system.

Azure Stack, presented at Microsoft Inspire 2017, allows clients to have on-premises Azure services, guaranteeing the control of where application and workload lie. Application development and deployment happens with the same approach used with the Azure public cloud: because of that, Microsoft talks about a “totally coherent hybrid cloud platform”.

AWS and VMware together with an hybrid cloud solution?

Citing anonymous sources, The Information reports that VMware and AWS are considering a partnership to design software products for datacenters. No additional details or further information are available.

For AWS, the value of VMware lies in its vast user base in enterprise datacenters, while it’s vital for VMware to help clients to create and manage and hybrid cloud environment that merges on-premises availabilities with the one offered by cloud providers.

The two companies already have a partnership that has been going on since a year, with the aim of helping companies migrating existing VMware environments towards AWS. Essentially VMware sells tools to manage AWS in the same way one manages on-premises VMware products.